Cash Flow

Growth

Scaling a business is expensive. Like, really expensive. And the kicker? Even when your business is profitable, it can still feel like cash is being sucked into a black hole.

Here’s a stat to wake you up: 90% of startups fail, and 82% of those failures are down to cash flow problems.

Too many business owners assume that more sales equals more cash. It’s not that simple. Sure, more sales can bring in more profit, but that doesn’t mean more cash. In fact, as you grow, you’re more likely to end up with less cash in the bank than you started with.

This is especially true for businesses holding stock or selling physical products. No wonder so many eCommerce businesses look to investors for funding!

The key to getting your cash under control? Understanding your Cash Conversion Cycle (CCC).

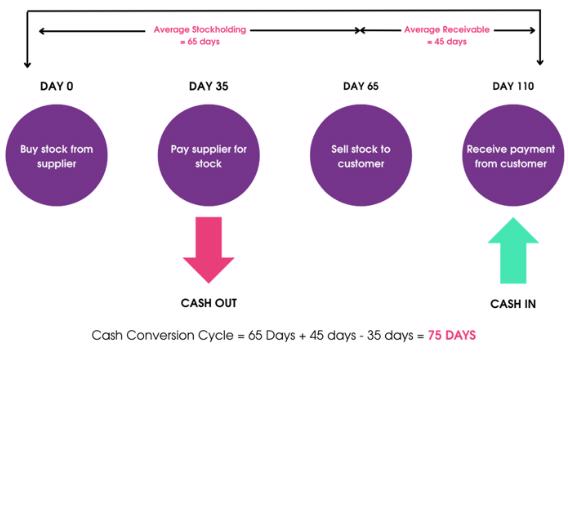

The CCC measures how long it takes to turn your stock into actual cash. The shorter, the better — because less cash is tied up, giving you more flexibility as you grow.

The formula is simple:

CCC = Stockholding Days + Receivable Days – Payable Days

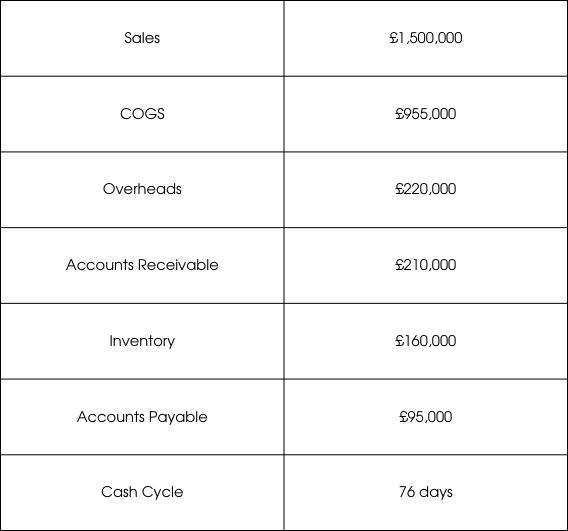

This is the average number of days you hold stock before selling it.

Formula: (Average Stock ÷ COGS) × 365

This measures how long it takes for customers to pay you.

Formula: (Average Accounts Receivable ÷ Sales) × 365

This tells you how long it takes for you to pay your suppliers.

Formula: (Average Accounts Payable ÷ COGS) × 365

While the formula might seem straightforward, make sure your numbers are clean before calculating.

It’s not enough to just calculate your CCC; you need to understand what it means. The shorter your CCC, the less time your cash is tied up in your business. That’s cash you could be using for other things, like investing in growth.

Some businesses even achieve a negative CCC. Companies like Amazon and GymShark are perfect examples. A negative CCC means they’re getting paid by customers before they pay suppliers — the dream scenario. It means their growth is funded by their suppliers and customers, not their own money.

Most businesses can’t pull this off, but the goal is to shave as many days as possible off your CCC.

Let’s say reducing your CCC by just 7 days gives you an additional £50k in cash. Imagine what you could do with that extra capital!

By reducing debtor days by 9 and inventory days by 6, you increase your cash by £52,685. That’s serious money.

Want to reduce your CCC and unlock more cash? Here’s how:

Even if you don’t hold stock, the same principles apply. For service-based businesses, think of stock as work in progress. Reducing the time between completing work and getting paid will improve your cash flow just the same.